First Home Buyers – Government Grants and Schemes (2023)

March, 2023

So, how long does it take to save 20% for your 1st home these days?

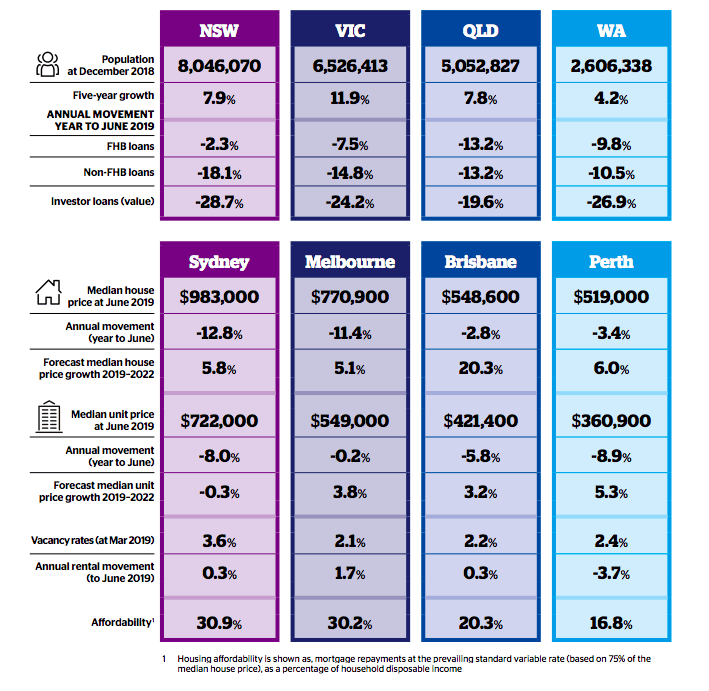

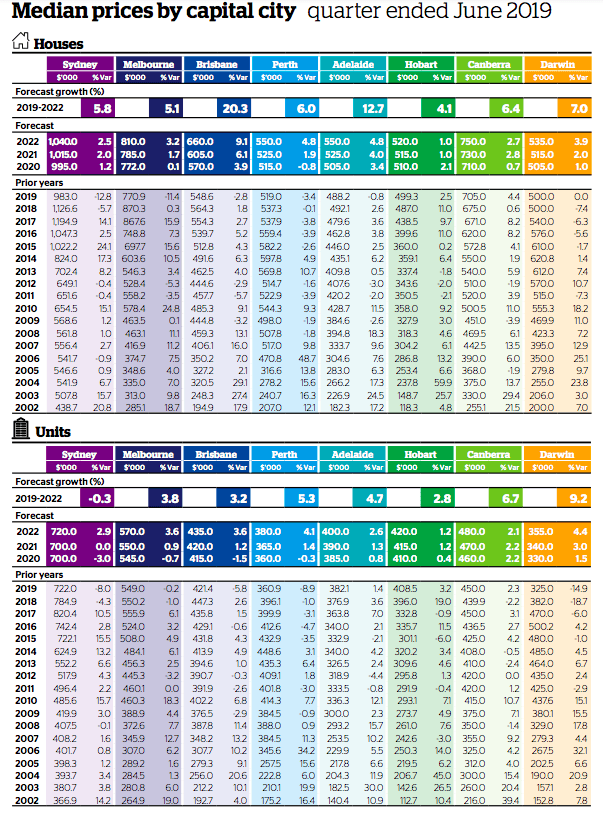

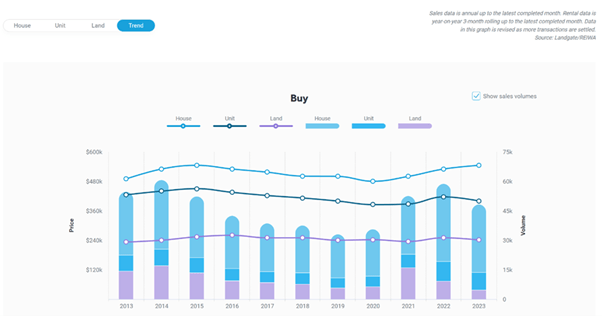

According to the recent release this week of the Domain First Home Buyer Report 2023, if you buy in Sydney, you’d have to save for over 6yrs 8mths but in sunny Perth its almost half that at 3 yrs 7mths! (Source: Nicola Powell)

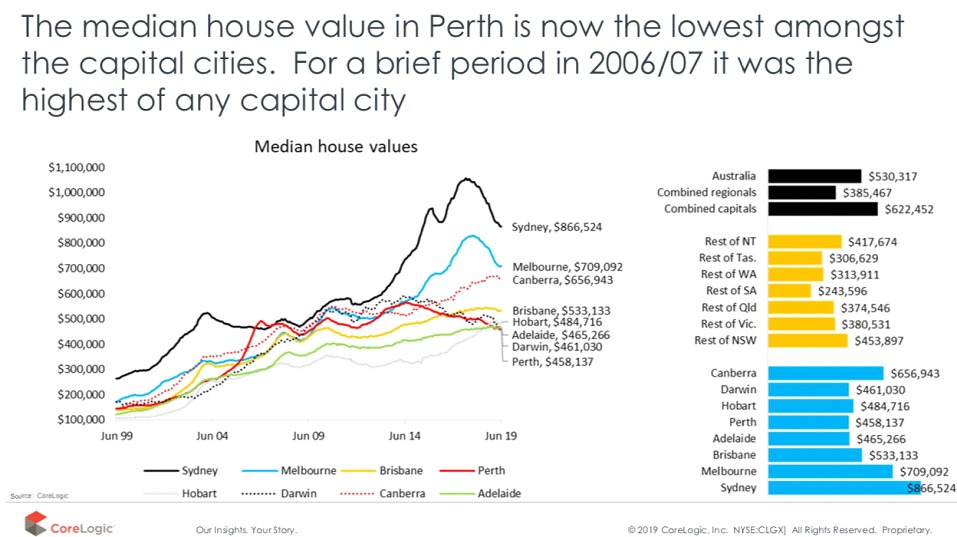

Amongst other factors, the main reason is because Perth’s median dwelling value is approximately $545,000 (REIWA, Mar2023) which makes it Australia’s second most affordable, and one of the worlds most liveable City’s (Source: REIWA/Landgate, Mar 2023).

Buying a home in #Perth is made all that more affordable through special incentives geared to get first home buyers into home ownership.

Here’s a reminder of 5 options available for first home buyers in WA:

- Home Guarantee Scheme (Australian Government backed with only 2-5% deposit required and with no LMI).

- 1st Home Owner Grants (WA Government FHOG offering $10k for new homes in Perth upto $750k).

- 1st Home Owner Rate ~ stamp duty concession (WA Government concessions up to $530k).

- Home Buyers Assistance Account (WA Government offering HBAA rebate of upto $2k for incidental costs, capped at $400k purchase price.

- 1st Home Super Saver Scheme (voluntary contributions in super to put towards your deposit).

To understand these options and eligibility requirements we have compiled the following excerpts with links below.

1) The Home Guarantee Scheme (HGS)

What is the Home Guarantee Scheme?

The Home Guarantee Scheme (HGS) is an Australian Government initiative to help you buy or build your first home sooner. You can buy your home with as little as 5% deposit and no Lenders Mortgage Insurance. It is not a cash payment or a deposit and not all major banks are participants. You can see the list of participating banks offering HGS here.

The HGS includes:

- The First Home Guarantee (FHBG) – to support eligible first home buyers to buy their first home sooner, with a deposit as little as 5%.35,000 places are available each financial year.

- The Regional First Home Buyer Guarantee (RFHBG) – to support eligible regional first home buyers to buy a home in a regional area. From 1 October 2022, 10,000 places are available each financial year to 30 June 2025

- The Family Home Guarantee (FHG) – to support eligible single parents with at least one dependent child to buy a home, with a deposit as little as 2%. 5,000 places are available each financial year to 30 June 2025.

Your purchased property must be an acceptable property type and within the property price threshold for the suburb and postcode. You can check the property price cap for your chosen area, and eligibility requirements for each of the benefits above, on NHFIC’s website – https://www.nhfic.gov.au/support-buy-home

2) First Home Owner Grant (FHOG)

Get access to a one-off $10,000 grant for the purchase or build of a new home.

To be eligible you must:

- buy or build a new residential property for use as your principal place of residence.

- not have owned property in Australia before.

- be an Australian citizen or a permanent resident of at least 18 years age.

- be an owner-occupier, not a residential investor.

- meet all the eligibility criteria under this scheme.

The value of your transaction is;

o South of the 26th parallel up to $750,000 (value of land and building). Note: All Perth metropolitan areas are south of the 26th parallel.

o North of the 26th parallel – value of land and building is up to $1,000,000.

A home that has been substantially renovated may be considered a new home. The grant is not available for the purchase of an established home or for renovations to an existing home. Refer to the eligibility requirements.

https://www.wa.gov.au/government/publications/fhog-fs

3) First Home Owner Rate (FHOR) ~ Stamp Duty Concession (WA)

Stamp Duty (transfer duty assessment) can be calculated by determining the dutiable value and applying the appropriate rate of duty.

- Dutiable value of home up to $430,000 = No Duty payable.

- Concessional rate is capped at $530,000.

A person may be entitled to the FHOR if the unencumbered value of the land, or the land and home, under the transaction does not exceed the dutiable value thresholds and:

- they qualify for the FHOG grant or

- they would have qualified for the grant except that the transaction was for the purchase of an established home or no consideration was paid under the transaction or they are an Indian Ocean Territory resident acquiring their first home.

https://www.wa.gov.au/government/publications/first-home-owner-duty-fs

4) Home Buyers Assistance Account (HBAA) (WA)

The scheme provides a grant of up to $2,000 for the incidental expenses of first home buyers when they purchase an established or partially built home through a licensed real estate agent.

The maximum purchase price criteria for the Home Buyers Assistance Account is $400,000.

5) First Home Super Saver Scheme (FHSS)

You can use your voluntary contributions in super to put towards your deposit.

From 1 July 2017, you can make voluntary concessional (before-tax) and voluntary non-concessional (after-tax) contributions into your super fund to save for your first home.

From 1 July 2018, you can then apply to release your voluntary contributions, along with associated earnings, to help you purchase your first home. You must meet the eligibility requirements to apply for the release of these amounts.

You can use this scheme if you are a first home buyer and both of the following apply:

- You will occupy the premises you buy or intend to as soon as practicable.

- You intend to occupy the property for at least 6 months within the first 12 months you own it, after it is practical to move in.

You can apply to have a maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $50,000 contributions across all years. You will also receive an amount of earnings that relate to those contributions.

To be eligible you must:

- not have owned property in Australia before

- be an Australian citizen of at least 18 years age

- not previously had funds released from superannuation under this scheme

- meet all the eligibility criteria under this scheme.

Only voluntary contributions can be accessed as part of the FHSS scheme. Certain types of contributions are not eligible to be withdrawn under the FHSS scheme, including:

- compulsory employer contributions (eg: Superannuation Guarantee)

- spouse or child contributions

- Government co-contribution

- Contributions made by another individual or entity on your behalf (except where your employer makes additional contributions for you under an agreed salary sacrifice arrangement), and

- voluntary contributions to defined benefit funds or constitutionally protected funds.

We recommend you research further to confirm eligibility of the above via the links provided.

If you have found this information helpful please share amongst your network.

If you’re a 1st home buyer ready to buy and seek good quality, experienced and honest advice to help you secure a home to be proud of, please reach out to me.

I’m passionate about helping you reach your real estate goals!

Chiara Pacifici | Buyers Agent | Licensee | 0419 953 079